Protect every grant. Empower every caregiver

Protect every grant. Empower every caregiver

Protect every grant. Empower every caregiver

Manage grants, programs, and team spending with confidence. Stay audit-ready and mission-focused.

Manage grants, programs, and team spending with confidence. Stay audit-ready and mission-focused.

Manage grants, programs, and team spending with confidence. Stay audit-ready and mission-focused.

Application Approved

Welcome to Holdings!

Account Funded

Funds have been added to your account!

New Card Added!

New debit card added to your account.

Message from your bookkeeper

Your books are now closed and up to date—let me know if you have any questions!

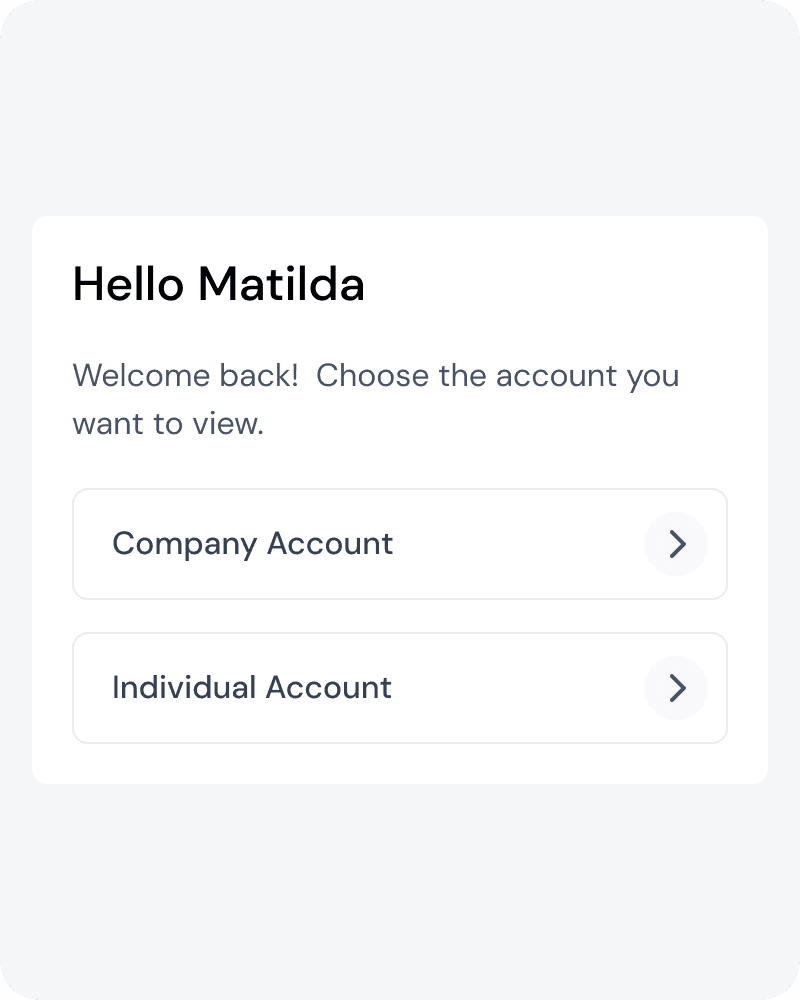

Personal Account Created

Personal and business in the same place

Application Approved

Welcome to Holdings!

Account Funded

Funds have been added to your account!

New Card Added!

New debit card added to your account.

Message from your bookkeeper

Your books are now closed and up to date—let me know if you have any questions!

Personal Account Created

Personal and business in the same place

1 Holdings is a financial technology company and is not a bank. Banking services are provided by i3 Bank, Member FDIC. The Holdings Visa Debit Card is issued by i3 Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

1 Holdings is a financial technology company and is not a bank. Banking services are provided by i3 Bank, Member FDIC. The Holdings Visa Debit Card is issued by i3 Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

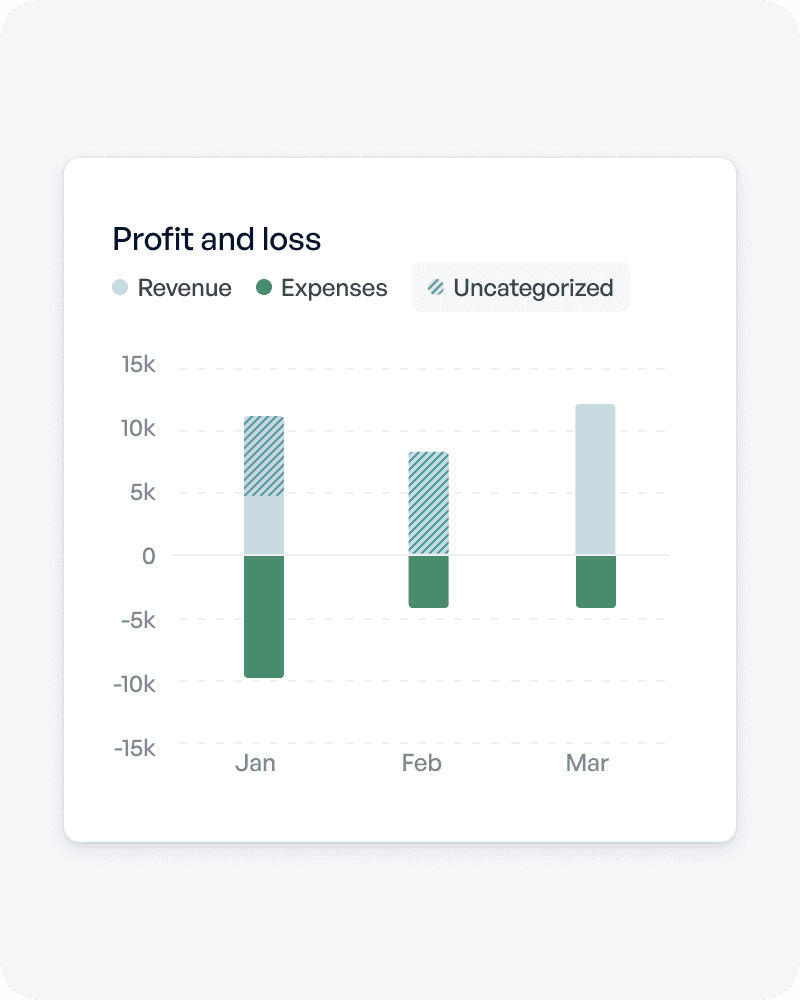

What we do best

What we do best

One platform for banking, accounting, and bookkeeping

One platform for banking, accounting, and bookkeeping

Get Paid Faster

Coming Soon

Grow Your Reserves

Empower Your Team

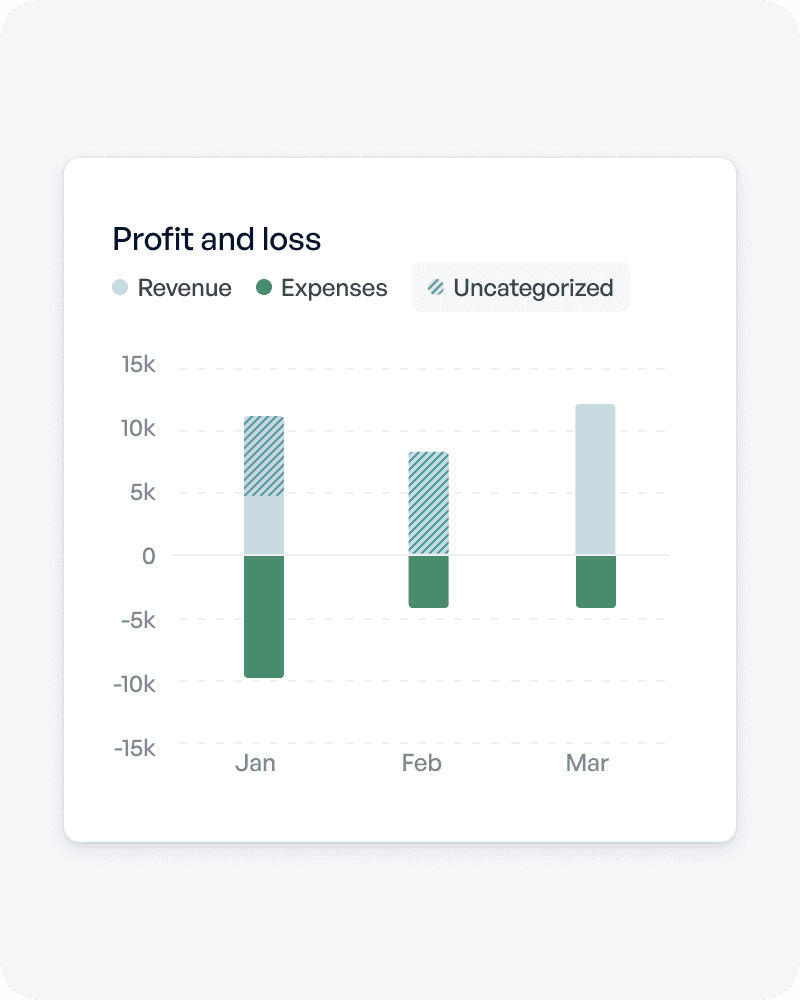

Healthcare Accounting

Audit-Ready Bookkeeping

No More Commingling

Get Paid Faster

Coming Soon

Grow Your Reserves

Empower Your Team

Healthcare Accounting

Audit-Ready Bookkeeping

No More Commingling

Focus on patient care, not dodging hidden costs.

No surprise fees². Every claim, every payout—yours to keep.

2 No account or domestic transaction fees. Some foreign transaction fees may apply in limited circumstances.

2 No account or domestic transaction fees. Some foreign transaction fees may apply in limited circumstances.

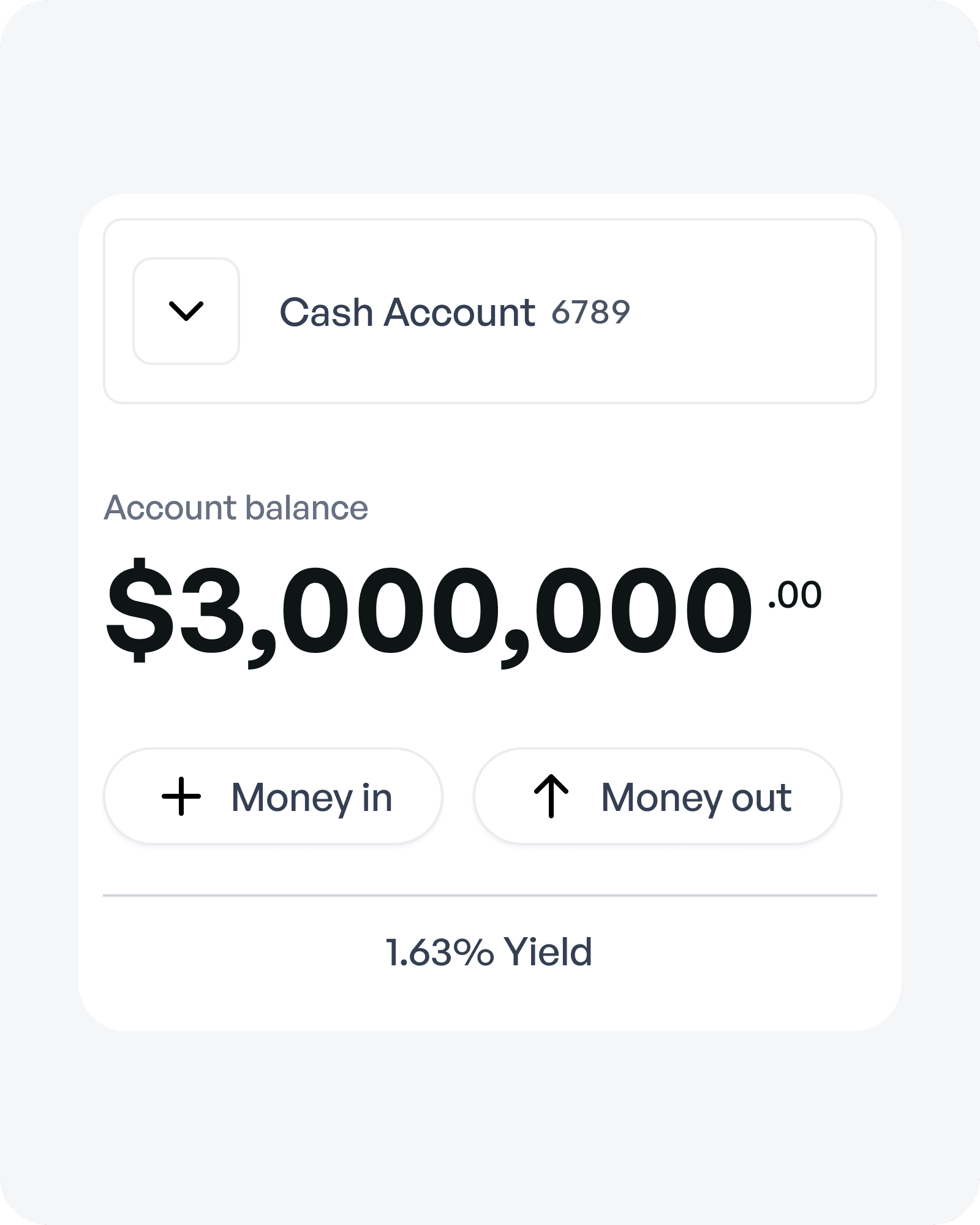

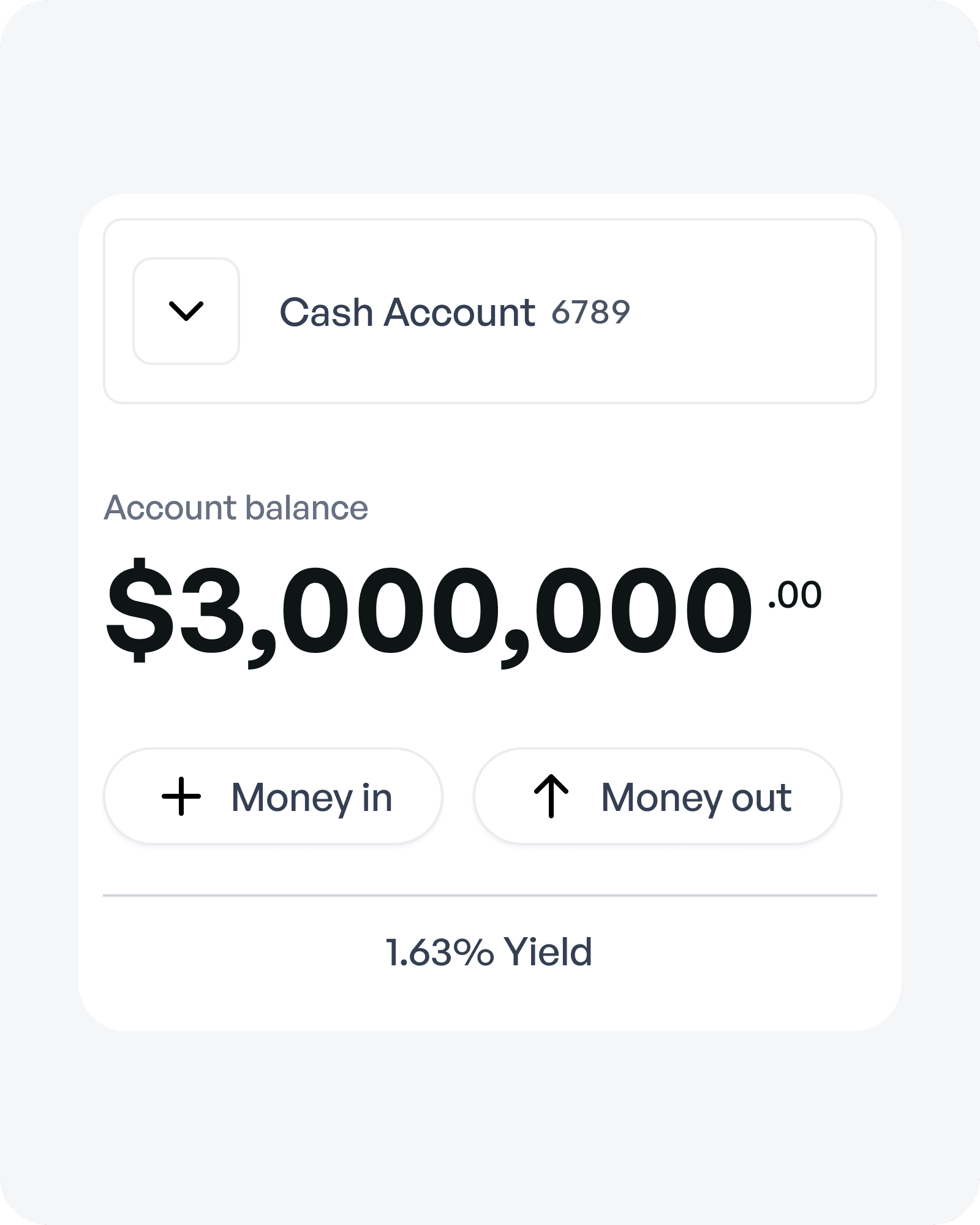

Your reserves, working for you.

Earn 1.63% APY on every dollar—no minimums, no hidden fees. Build a financial cushion for payroll, equipment, or expansion.

3 Annual Percentage Yield (APY) is variable and subject to change after account opening. Rate is compounded monthly and credited monthly.

3 Annual Percentage Yield (APY) is variable and subject to change after account opening. Rate is compounded monthly and credited monthly.

1.63

%

APY

Banking Built for Healthcare

Our commitment to products that help small businesses grow and succeed has earned trust of customers nationwide

Our commitment to products that help small businesses grow and succeed has earned trust of customers nationwide

$3M+ FDIC

Your operating funds are protected up to three million, twelve times the standard FDIC limit. That’s real security for practices managing payroll, equipment, and expansion.

$3M+ FDIC

Your operating funds are protected up to three million, twelve times the standard FDIC limit. That’s real security for practices managing payroll, equipment, and expansion.

$3M+ FDIC

Your operating funds are protected up to three million, twelve times the standard FDIC limit. That’s real security for practices managing payroll, equipment, and expansion.

Smart Debit Cards

Issue cards for staff, set spending limits, and track every purchase—no fees, no surprises. Every transaction is automatically categorized for easy reconciliation.

Smart Debit Cards

Issue cards for staff, set spending limits, and track every purchase—no fees, no surprises. Every transaction is automatically categorized for easy reconciliation.

Smart Debit Cards

Issue cards for staff, set spending limits, and track every purchase—no fees, no surprises. Every transaction is automatically categorized for easy reconciliation.

SOC Compliant

Holdings meets the highest standards for data protection—SOC compliance and HIPAA-ready data management—so your patient and financial data stay safe and audit-ready

SOC Compliant

Holdings meets the highest standards for data protection—SOC compliance and HIPAA-ready data management—so your patient and financial data stay safe and audit-ready

SOC Compliant

Holdings meets the highest standards for data protection—SOC compliance and HIPAA-ready data management—so your patient and financial data stay safe and audit-ready

Welcome to Holdings FAQ!

Everything You Need to Know About Holdings

Everything You Need to Know About Holdings

How do I open a business account with Holdings for my healthcare practice?

How do I open a business account with Holdings for my healthcare practice?

How do I open a business account with Holdings for my healthcare practice?

Are there any fees for transactions, wires, or monthly maintenance?

Are there any fees for transactions, wires, or monthly maintenance?

Are there any fees for transactions, wires, or monthly maintenance?

How quickly can I access my insurance reimbursements and patient payments?

How quickly can I access my insurance reimbursements and patient payments?

How quickly can I access my insurance reimbursements and patient payments?

Can I create multiple accounts for different needs (payroll, taxes, equipment, etc.)?

Can I create multiple accounts for different needs (payroll, taxes, equipment, etc.)?

Can I create multiple accounts for different needs (payroll, taxes, equipment, etc.)?

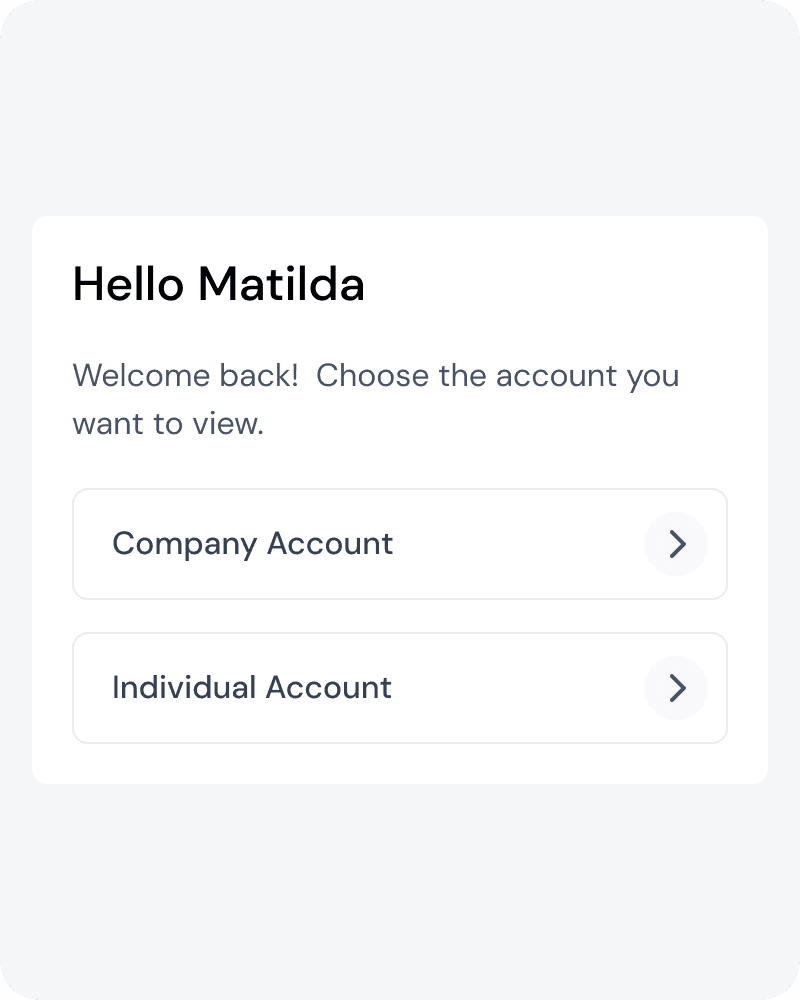

Can I manage both my practice and personal finances with Holdings?

Can I manage both my practice and personal finances with Holdings?

Can I manage both my practice and personal finances with Holdings?

How is my money protected with Holdings?

How is my money protected with Holdings?

How is my money protected with Holdings?

The Stewardship Blog

The Stewardship Blog

Where nonprofit leaders find practical advice to make every dollar go further.

Where nonprofit leaders find practical advice to make every dollar go further.

Where nonprofit leaders find practical advice to make every dollar go further.

Sign up for Good Growth

The nonprofit newsletter with the insights you actually need

Stay in the know with the latest nonprofit news, funding updates, compliance tips, and financial insights in plain English. Just real talk for real impact.

Sign up for Good Growth

The nonprofit newsletter with the insights you actually need

Stay in the know with the latest nonprofit news, funding updates, compliance tips, and financial insights in plain English. Just real talk for real impact.

Sign up for Good Growth

The nonprofit newsletter with the insights you actually need

Stay in the know with the latest nonprofit news, funding updates, compliance tips, and financial insights in plain English. Just real talk for real impact.